BTC Price Prediction: Analyzing Technical Signals and Market Drivers for 2025

#BTC

- Technical indicators show BTC is oversold with MACD suggesting momentum shift

- Institutional adoption continues through ETF purchases and corporate treasury allocations

- Near-term volatility expected from options expiry and regulatory developments

BTC Price Prediction

BTC Technical Analysis: Key Indicators Signal Potential Reversal

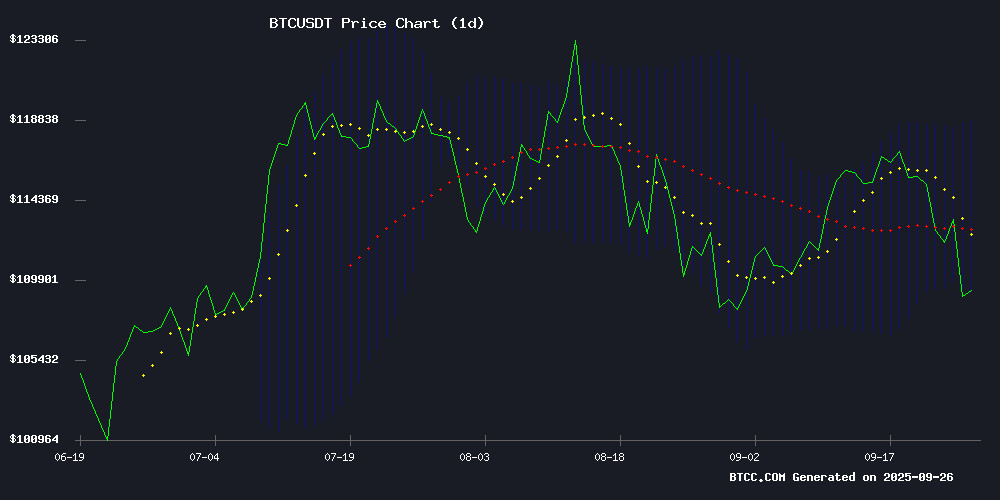

BTC currently trades at $109,042, below its 20-day moving average of $113,980, indicating short-term bearish pressure. However, the MACD shows promising signs with the histogram at +1,416, suggesting weakening downward momentum. Bollinger Bands reveal price trading NEAR the lower band at $109,131, which often serves as support. According to BTCC financial analyst Robert, 'The convergence of MACD improvement and Bollinger Band positioning hints at a potential rebound toward the middle band at $113,980 if current support holds.'

Mixed Market Sentiment as Institutional Activity Contrasts with Regulatory Concerns

Positive institutional developments including BlackRock's $77 million ETF purchase and OranjeBTC's substantial acquisition of 3,650 BTC provide strong fundamental support. However, market sentiment is tempered by regulatory uncertainties from the Czech scandal and Jim Cramer's warning about volatility. BTCC financial analyst Robert notes, 'The $17.5 billion options expiry creates near-term pressure, but institutional accumulation patterns suggest longer-term confidence despite ETF inflow fluctuations.'

Factors Influencing BTC's Price

OranjeBTC Acquires 3,650 BTC, Becomes Latam's Largest Bitcoin Treasury

Brazil-based OranjeBTC has cemented its position as Latin America's dominant bitcoin treasury firm after acquiring 3,650 BTC worth approximately $385 million. The purchase at an average price of $105,300 per bitcoin surpasses regional competitor Meliuz's holdings of 605 BTC.

Founded by ex-Bridgewater Associates partner Guilherme Gomes, the company operates as a pure-play bitcoin accumulator for institutional and retail investors. Its October reverse IPO plans signal ambitions to become the continent's premier public bitcoin entity while driving cryptocurrency education initiatives.

Notable backers including Gemini's Winklevoss twins, cryptographer Adam Back, and billionaire Ricardo Salinas lend credibility to OranjeBTC's treasury-focused model. This contrasts with Meliuz's cashback-oriented approach to bitcoin exposure.

Crypto Wealth Boom Creates Quarter-Million Millionaires as Market Cap Soars

The cryptocurrency market's wealth expansion has reached a historic milestone, with nearly 250,000 individuals now holding digital asset portfolios valued at $1 million or more. Henley & Partners' Crypto Wealth Report reveals a 40% annual increase in crypto millionaires, mirroring the sector's 64.5% growth to a $3.75 trillion market capitalization.

Bitcoin fortunes lead the charge, with 145,100 BTC millionaires marking a 70% surge year-over-year. The elite tiers show even more concentrated wealth—450 investors control nine-figure crypto holdings, while 36 have achieved billionaire status through digital assets. This acceleration coincides with unprecedented institutional adoption, including landmark crypto initiatives by US political figures.

"Geography has become optional in wealth preservation," observes Dominic Volek of Henley & Partners, highlighting crypto's disruption of traditional finance paradigms. Where physical presence and jurisdictional ties once dictated asset management, decentralized technologies now enable borderless value storage—a fundamental shift with profound implications for global capital flows and regulatory frameworks.

Jim Cramer Warns American Bitcoin (ABTC) Investors of High Risk Amid Market Volatility

CNBC's Jim Cramer delivered a stark warning to investors in American Bitcoin (ABTC), the mining firm linked to Eric Trump and backed by Hut 8. During his Mad Money Lightning Round, Cramer labeled ABTC as "pure speculation," cautioning that while it might offer profit potential, the risk of total loss looms large. His comments followed a 4.29% drop in ABTC shares to $6.69, mirroring broader crypto market declines.

The company, which recently debuted on Nasdaq after merging with Gryphon Digital Mining, positions itself as a leader in Bitcoin mining. Hut 8, a major corporate Bitcoin holder, holds a majority stake. Cramer's skepticism underscores the volatile nature of crypto-related stocks, even those with high-profile backers.

Bitcoin Price Prediction: $15K Swing Looms as Volatility Compresses

Bitcoin's price action has entered a phase of tight consolidation, trading near $109k with Bollinger Bands and Average True Range (ATR) hitting multi-week lows. The rangebound movement between $108k and $113k reflects market indecision ahead of critical macroeconomic catalysts and crypto-specific events.

Technical analysts observe a coiled spring setup—a breakout above $113k could trigger momentum toward $120k-$125k, fueled by spot ETF inflows and whale accumulation. Conversely, failure to hold $108k support may precipitate liquidations targeting the $100k psychological level or even mid-$90k territory.

The September 26, 2025 trading session finds BTC at an inflection point, with a $15k implied volatility swing priced into near-term options. Market participants await clarity from Federal Reserve policy signals and this week's $2.5 billion options expiry, which could determine Bitcoin's next directional bias.

Curve Finance Founder Launches Bitcoin Yield Protocol to Tackle Impermanent Loss

Michael Egorov, the founder of Curve Finance, has introduced Yield Basis, a decentralized protocol designed to generate sustainable Bitcoin yields while eliminating impermanent loss—a persistent challenge in decentralized finance. Bitcoin holders have historically faced limited on-chain yield opportunities, with lending markets offering minimal returns and automated market maker pools exposing users to value erosion when token prices diverge.

Yield Basis reengineers the AMM model by completely removing impermanent loss risk, aiming to attract institutional and professional investors with deeper Bitcoin liquidity. The protocol launched with three pools, each capped at $1 million in deposits to manage early growth. Borrowing from Curve's resilient infrastructure, Yield Basis incorporates a vote-escrow mechanism (veYB) for governance, requiring token holders to lock YB to participate and earn fees distributed in crvUSD or wrapped Bitcoin.

The project, which secured $5 million in early 2025 funding, ties token emissions to position yield rather than indiscriminately distributing them to liquidity providers—a model Egorov describes as "value-protecting."

$1.15B FTX Lawsuit Exposes Broken Trust While MAGAX Presale Offers a Transparent Alternative

The fallout from FTX's collapse continues to reverberate through crypto markets. A $1.15 billion lawsuit filed by the FTX Recovery Trust against a Bitcoin mining firm alleges billions in customer funds were funneled through Alameda Research to Genesis Capital. Court documents claim over half these funds went directly to Genesis co-founders, leaving retail investors empty-handed.

This case underscores the systemic risks of opaque financial practices in digital asset markets. The lawsuit reveals how inflated valuations and lax oversight disproportionately harm retail participants—a pattern seen repeatedly since FTX's implosion. Genesis reportedly executed deals without proper audits, enabling insiders to profit while late entrants bore the losses.

Amid this crisis of confidence, projects like MAGAX are positioning transparency as a competitive advantage. Their presale structure emphasizes verifiable safeguards—a direct counter to the industry's legacy of broken promises. Market participants increasingly demand this accountability, signaling a potential shift toward more sustainable token distribution models.

BlackRock Expands Bitcoin ETF Reserves with $77 Million Purchase

BlackRock, the world's largest asset manager, has added 703.7 BTC worth approximately $77 million to its IBIT Bitcoin ETF holdings. The acquisition, tracked via on-chain data, reflects the firm's consistent accumulation strategy rather than one-off purchases—a clear signal of long-term conviction in Bitcoin's value proposition.

Arkham Intelligence reports the transactions were executed across multiple ETF-linked custody wallets, with individual transfers averaging 300 BTC ($32 million) within a five-hour window. Coinbase Prime, BlackRock's designated custodian, facilitated portions of the flow. The structured distribution across addresses (bc1qv, bc1qd, bc1q4) demonstrates institutional-grade risk management through custodial diversification.

Bitcoin (BTC) Faces Market Exhaustion Amid ETF Inflow Slowdown

Bitcoin's post-FOMC rally shows signs of fatigue as long-term holders cash in profits. Glassnode data reveals 3.4 million BTC realized gains—surpassing previous cycle peaks—while ETF demand wanes. The cryptocurrency briefly touched $117,000 before entering a corrective phase, though on-chain metrics suggest milder drawdowns compared to historic pullbacks.

Capital rotation remains robust with $678 billion in realized cap inflows, but the slowdown in ETF purchases exposes market fragility. This distribution phase mirrors classic top formation patterns, where veteran investors typically offload holdings to new entrants. The question now: whether institutional flows can sustain momentum absent retail fervor.

Bitcoin Price Prediction: BTC Drops Below $110k Ahead of Key Inflation Data

Bitcoin faces renewed bearish pressure as investors brace for pivotal U.S. economic data releases. The cryptocurrency plunged 3.80% to a weekly low of $108,623 on Thursday before recovering slightly to $109,382. Market sentiment remains cautious ahead of inflation figures, jobless claims, and Q2 GDP readings that could influence Federal Reserve rate decisions.

Thin liquidity and excessive leverage exacerbated the selloff, pushing BTC below the psychological $110,000 threshold. While short-term sentiment leans bearish, traders are exploring alternative opportunities like Bitcoin Hyper—a promising Bitcoin Layer-2 solution that has raised $18 million ahead of its anticipated 2025 launch.

Recent economic indicators show mixed signals: weekly jobless claims declined while Q2 GDP demonstrated unexpected resilience. These conflicting data points create uncertainty about the timing of potential Fed rate cuts, keeping crypto markets on edge.

Bitcoin Price Volatility Intensifies Ahead of $17.5 Billion Options Expiry

Bitcoin's sharp decline today dragged altcoins lower, though analysts characterize the move as part of a normal trading range rather than systemic weakness. The cryptocurrency follows its historical pattern of 'five steps forward, two steps back'—a rhythm long observed in cyclical crypto markets.

Market structure appears fragile ahead of Friday's $17.5 billion BTC options expiry. The max pain point sits at $107,000, a level that tends to magnetize price action during large derivatives settlements. Liquidity sweeps below $111,000 already liquidated over-leveraged longs, with $107,000-$108,000 now acting as the next battleground.

'$BTC usually bottoms in September,' noted one trader. 'This options expiry could catalyze the final flush before reversal.' Raoul Pal's extended cycle theory suggests the traditional four-year Bitcoin rhythm may now require five years to complete—a potential paradigm shift for timing market turns.

Bitcoin Price Drops 2% Amid Czech Regulatory Scandal

Bitcoin fell 2.02% to $109,534.47 as regulatory concerns emerged from the Czech Republic. The resignation of Justice Minister Pavel Blažek over a Bitcoin donation scandal has weighed on market sentiment, overshadowing what was otherwise Bitcoin's strongest September performance on record.

Technical indicators show BTC approaching oversold territory with an RSI of 38.00, suggesting potential for a near-term bounce. The cryptocurrency had surged 7.39% earlier this month before the regulatory headwinds emerged.

The scandal involves 468 BTC donated to the Czech Ministry of Justice by convicted criminal Tomáš Jiřikovský, raising money laundering concerns. This development highlights how quickly regulatory issues can shift sentiment in crypto markets, even during periods of strong performance.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents a compelling investment case with important considerations. The technical setup shows potential for near-term recovery toward $113,980, while institutional adoption continues to grow substantially.

| Factor | Assessment | Impact |

|---|---|---|

| Technical Position | Oversold with reversal signals | Positive |

| Institutional Flow | Strong accumulation continuing | Positive |

| Regulatory Environment | Mixed with some concerns | Neutral/Negative |

| Market Volatility | Elevated due to options expiry | Short-term negative |

BTCC financial analyst Robert suggests, 'Investors should consider dollar-cost averaging given the current technical discount relative to institutional buying patterns.'